Originally Published 5.24.2024

By installing an ingenue CEO, the grand old dame of American eateries, Cracker Barrel, has sailed its once sturdy ship of comfort food straight into an iceberg of irrelevance. It’s a story of ambition and miscalculation, remarkably reminiscent of the final, ill-fated voyage of the Titan submersible. Let’s dive in, shall we?

Julie Felss Masino, the girl boss who thought she could navigate Cracker Barrel away from the treacherous territory of modern consumerism, embarked on her journey with a blend of youthful overconfidence and a plucky lack of foresight. Ms. Masino, much like OceanGate’s DEI-inspired CEO Stockton Rush, believed that she could boldly repurpose a modified video-game controller to steer the old ship into new, uncharted waters. By ignoring the boring middle-aged white men along the way — both those with the experience to know better, and those who comprise the customer base — she has instead steered the company straight into the abyss.

Masino’s declaration of irrelevance on a recent investor call was akin to that sinking moment when Titan lost contact with its surface vessel for the last time. It was a brutally honest pronouncement, boldly served and utterly catastrophic. The market’s response was as unforgiving as Leviathan, swallowing the company’s value in one satisfying gulp and asking for seconds.

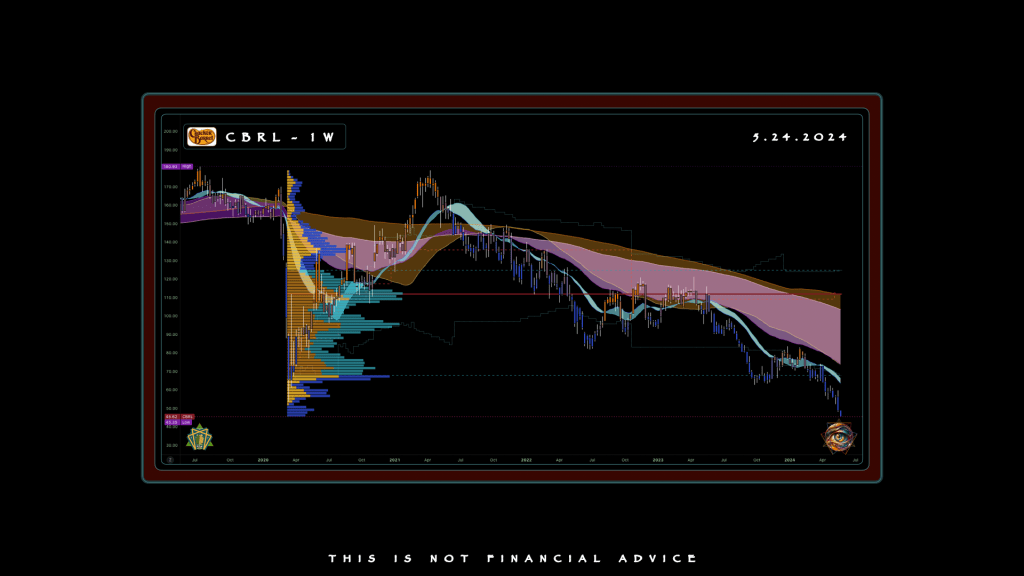

Investors, like the families of those aboard the Titan, watched in horror as Cracker Barrel’s stock price plummeted into the void, losing 25% of its value in a matter of days.

The Titan submersible, a marvel of modern engineering — or so its investors were led to believe — descended into the deep, dark ocean, aiming to explore the haunted remains of the Titanic. Instead of triumph, it met with cold, dark reality. Similarly, Ms. Masino’s decision to announce Cracker Barrel’s waning relevance was like the captain declaring to the Board, “Folks, we’re going under.”

Cracker Barrel, once the heart and soul of road trips across the U.S. (a dying pastime for related and unrelated reasons), is shedding locations faster than the waters of a spent tsunami returning to the sea.

With four more closures this year — Sacramento, Santa Maria, Medford, and Columbia — joining last year’s Oregon trio, this country-themed relic is circling the drain. CEO Julie Felss Masino has only been in the captain’s chair for nine months, and already she’s facing a rainbow implosion. In a starkly honest investor call, she flat-out admitted, “We’re just not as relevant as we once were.”

This confession torpedoed the stock to a humiliating $45.35, below its Covid lows, to prices not seen in over a decade. As if to rub single-serving salt-and-pepper into the wound, the yearly dividend was slashed from $1.30 per share to a meager 25 cents.

In a last-ditch effort to bring the “good ol’ days” back to life, Cracker Barrel is throwing $700 million at the problem.

The menu is getting that much-needed facelift you’ve been demanding, with new offerings like premium savory chicken and rice, slow-braised pot roast, and hashbrown casserole shepherd’s pie. Surely that will lead the stock price in to a V-shaped recovery, right? Wait for it: these dishes are set to debut this fall. There’s even an exciting “experimental phase”, aimed at gauging customer reaction, featuring the roll-out of green chili cornbread and banana pudding in over 10 locations!

The plan is bold and clear: diversify the menu to appeal to a broader, less discriminating palate. But will these changes be enough to win over the finicky younger crowd while keeping the traditionalists happy? This bored ape thinks it’s gonna take more than bananas to whip today’s crowds into a frenzy.

To satisfy investors’ neglected appetite, crypto gift certificates are a no-brainer. It’s a culinary tightrope walk that can only be stabilized by the balance beam of NFTs, right? Chicken and Rice are not the only catalysts, either.

Cracker Barrel’s pricing strategy is about to get an even more major shake-up, too.

Currently, about 60% of its restaurants fall into the lowest cost tier, but Ms. Masino plans to realign prices with local economic conditions. The goal is to raise prices in wealthier areas and lower them in less affluent regions. For example, some stores in metro areas with an average household income of $55,000 are in the same pricing tier as those where the average is $90,000.

This Robin Hood pricing strategy is under review, aiming to capitalize on the inefficiencies created by the economic mismatch; adjustments are on the horizon that could threaten industry stalwarts like Ruth Chris and Wolfgang Puck.

Up to 30 stores are set for a significant remodel next fiscal year. The new look will feature a fresh color palette, updated lighting, more comfortable seating, and simplified decor and fixtures. The idea is to refresh the brand’s image while maintaining its signature rustic charm. This facelift aims to attract a new generation of diners who are more likely to Instagram their meal than reminisce about family road trips.

Additionally, new locations opening in fall 2025 will be about 15% smaller. This downsizing reflects a strategic shift in restaurant design, pretending to create a more intimate dining experience while possibly cutting those CRE costs.

Financially, Cracker Barrel is in the ICU. Analysts predict a quarterly earnings decline of 53.7%, with revenues expected to hit $826.55 million, down 0.7% from last year. Over the past month, Cracker Barrel’s shares have tanked 24.8%, starkly contrasting the Zacks S&P 500 composite’s +4% change. The company’s Zacks Rank #5 (Strong Sell) suggests that Wall Street has little faith in its near-term prospects.

Cracker Barrel isn’t the only classic American chain in icy hot water. Red Lobster recently filed for Chapter 11 bankruptcy protection after closing nearly 100 restaurants, blaming explosive lease and labor costs. Speculators are blaming the Endless Shrimp. This year so far, 35 “underperforming” Applebee’s locations have imploded, continuing a trend of closures trailing back to 2017. Verily, the dining landscape is underwater, with familiar chains struggling to shake off the rust.

Cracker Barrel’s past controversies haven’t helped, either. First, the company’s anti-LGBT policies of the 1990s came back to bite them on the ass with the progressives. Then, the recent backlash over rainbow-colored rocking chairs during Pride Month has polarized the traditional core customers. It’s a cultural balancing act absurdly akin to an old-school waitress racing with an overloaded tray through Sunday morning rush hour after Service.

Despite these hurdles, Cracker Barrel’s leadership remains cautiously optimistic. Then again, what options do they have? The company’s plan involves not just menu innovation and pricing adjustments but also a significant brand overhaul. However, Truist analyst Jake Bartlett’s skepticism highlights the uncertainty: “They announced a plan for a plan, but they didn’t give investors enough information to judge whether reinvesting in the stores was a credible plan to address the traffic losses.”

The restaurant’s broader strategy — to modernize the menu, pricing, and experience — aims to claw its way back to some semblance of relevance in a competitive, no-nonsense market that is waking up from woke. But these changes will be a slow burn, like the new braised pot roast, with tangible benefits expected only in late 2026 and 2027. Until then, Cracker Barrel must survive a turbulent business environment, striving to regain its former glory while adapting to the ratcheting tension of the wider market dynamics.

At the bottom of the story, Cracker Barrel, like the Titan, is a symbol of ambition meeting its limits. The CEO’s bold declaration of irrelevance was as catastrophic as the sub’s fatal Father’s Day dive. Both stories remind us that the seas of business and exploration are perilous, demanding respect, preparation, and a deep understanding of one’s audience and environment. Ms. Masino, like the liquidated Stockton Rush, believed that she could pilot the treacherous waters of modern consumerism with bold moves and honest admissions. Both are tales of hubris, leadership, and the crushing weight of reality.

Leave a comment