How shall I put it? Um, the industrial crown jewel of Germany is barreling toward a cliff with failing brakes in a crisis that could punch a hole in the entire nation’s economy. For the first time in its 87-year history, Volkswagen is considering factory closures in Germany—ground zero for its workforce and symbolic heart.

The source of this chaos? Volkswagen is choking on its EV pivot. With profits down 11.4%, margins crumbling to 5.6% for 2024 and a €17 billion price tag merely to stabilize, CEO Oliver Blume is running out of road. Meanwhile, over 120,000 workers are staring down 10% pay cuts, sparking protests that have already shut down production.

Volkswagen is primarily listed on the Frankfurt Stock Exchange, but it’s also available to American investors through American Depository Receipts (ADRs).

Volkswagen’s ticker symbol, VWAGY, represents the company’s ordinary shares trading over-the-counter (OTC) in the United States. For U.S. investors, VWAGY or VWAPY are likely the most straightforward options and/or via its holding company.

- VWAGY: Represents ordinary shares with voting rights

- VWAPY: Represents more liquid preference shares w/o voting rights

- POAHY: Represents Porsche Holding Co., Volkswagen’s majority shareholder

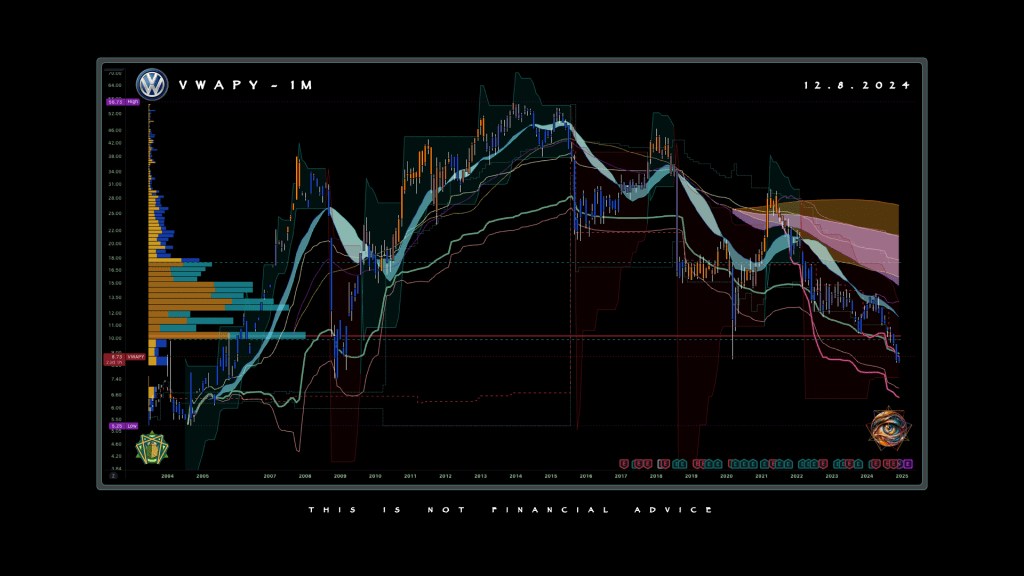

The monthly chart for VWAPY indicates a prolonged bearish trend. Price action is firmly below the Triple Differential MA Braid, as well as prior accumulation ranges, indicating more downward momentum to follow. Anchored VWAPs highlight the stepwise decline to the volume profile’s point-of-control. The widening gap between the moving averages underscores accelerating bearish sentiment. The volume profile teases potential support, but sustained weakness could lead to an irrecoverable breakdown. The lack of upward momentum suggests limited recovery in the short term, barring any major fundamental catalyst. Forecast: Continued downside could trigger a sharper decline toward multi-decade lows.

Volkswagen doesn’t have an electric “People’s Car,” and demand for EVs is falling short of rosy projections. Worse, producing EVs is a margin killer compared to their gasoline ancestors. Add Germany’s climate mandates—65% emissions cuts by 2030 and 15 million EVs on the road—and you’ve got a company stretched thinner than its profit margins.

Then there’s the China problem. Volkswagen is getting its teeth kicked in by Chinese EV makers who churn out cheaper, subsidized models while eating VW’s market share both at home and abroad. Germany’s big tariffs on Chinese imports? A band-aid on a gunshot wound when your core markets are eroding.

Trend Exhaustion pitchforks on the monthly chart reveal accumulation and distribution ranges coinciding with long-term anchored VWAP levels. Successive lower highs show bearish control, while price remains locked in a steep descending channel. Fibonacci color coding projects potential downside price and time target. Forecast: Given the persistent selling pressure, price is likely to retest $9 in the coming months.

The granularity of the daily chart reveals heightened volatility along a significant Euler range of the Trend Exhaustion (purple channel). The price is retesting the 21D moving averages, yet the liquidation events suggested by volume spikes at higher price points create a false sense of support. Forecast: Intraday bounces will tempt permabulls, but a sustained reversal is unlikely; daily volatility can increase, leading to sharp but short-lived moves.

The political fallout is already lighting fires. The IG Metall union is ready to turn protests into an industrial revolution, and Lower Saxony—a key Volkswagen shareholder—is panicking over the potential economic collapse of Wolfsburg. Factory closures would gut entire communities, turning stable jobs into ghost towns.

This isn’t just Volkswagen circling the drain. This is Germany’s auto sector—17% of its GDP—facing an existential reckoning. Blume’s only options? Reinvent the wheel or watch Germany’s industrial engine seize. Either way, it’s going to be messy.

Leave a comment