🔮 Nobody can predict the next move, yet anybody can metabolize the last failure before everybody else

In volatile markets, traders like to imagine they’re fast, but fast is no asset without clarity under pressure. That’s exactly why the OODA Loop—Observe, Orient, Decide, Act—was codified, and it isn’t a productivity hack. The Loop is a decision spiral built not to outsmart your opponent, but to out-cycle them. Originally designed by U.S. Air Force Colonel John Boyd to train air combat advantage, it functions equally well as a tactical operating system for traders who understand that speed is not reaction.

Every edge you think you have degrades the moment your Loop lags.

To loop well is to operate inside noise and still cut clean. It’s rhythm without hesitation, velocity with memory. Markets don’t care how pretty my indicators are. They don’t reward who sees first, but who sees through—faster. Like pilots in a dogfight, markets don’t care if you’re confident; they only care if you’re late.

To combat this predicament, the Loop was not built for theory, but for Edge Compression.

👁️ Observe

Observation is not passive awareness. It’s active filtration. You’re not scanning for signals. You’re hunting for intention hiding in structure. To observe well means you’ve already defined what matters. If you haven’t, the market will drown you in delayed confirmations and emotional bait.

There is no “pause” button.

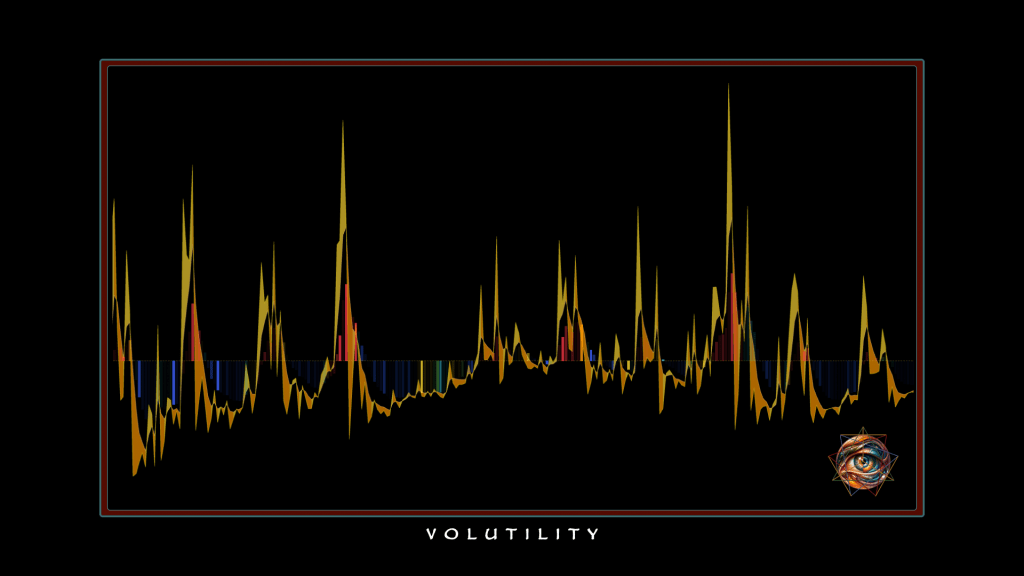

Observation in trading is time-framed. The asset moves whether you’re ready or not. The best observers don’t track price—they track pressure signatures. They know the difference between volume and urgency. They can feel when a candle means something before the indicators catch up. A good observational frame doesn’t clutter the chart. It builds context. Not just price + indicator overlays, but dynamic filters that track crowd behavior. Things like: ZVOL expansion into prior memory zones, OBVX slope versus effort, structure testing without follow-through.

Noise is everywhere. What matters is what breathes.

🧲 Orient

Orientation is the most dangerous step, because it happens inside you. Data is neutral. Orientation is bias layered over history, over fear, over identity. Traders fail here not because they can’t see the market—but because they can’t update how they interpret what they see. Your models must flex. Your map must redraw.

If you’re still interpreting today’s price action through last week’s correlations, your Loop is broken before you even click.

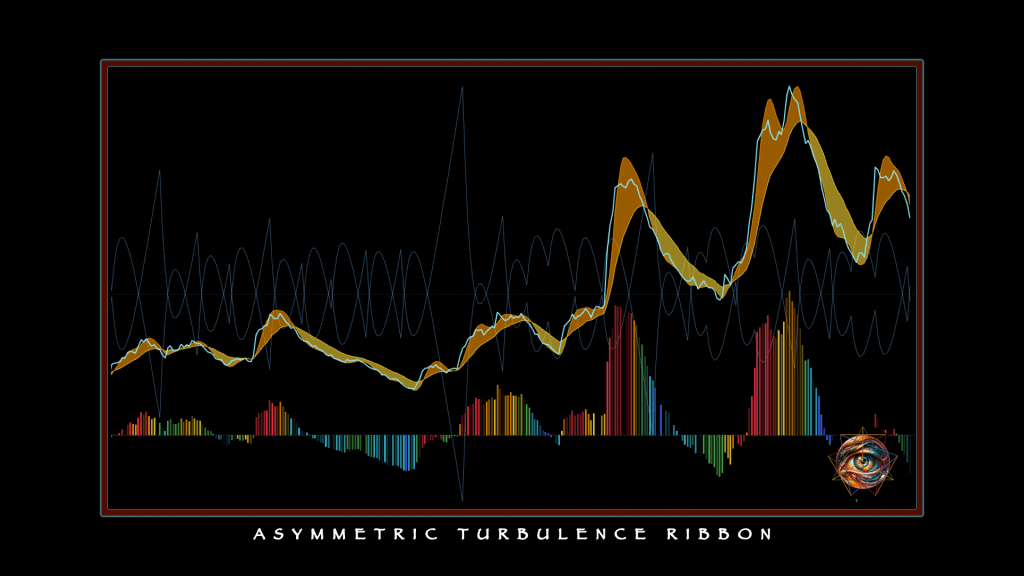

A clean orientation process respects memory, but doesn’t worship it. Price structure that mimics a prior setup might seduce you. But if volume doesn’t agree, or the macro terrain has shifted, your map is a mirage. Real orientation adapts in real-time. The best traders use orientation to model regret before it happens. They ask: is the crowd returning because it sees value—or because it missed the last move and wants revenge? If you can’t answer that, your orientation is off. You’re seeing price, not posture.

🔪 Decide

Decision is not conviction. It’s clarity under asymmetry. Good decisions aren’t always fast—but they are prepared. The best trades aren’t made in the moment. They’re preloaded playbooks, if-then branches, kill switches. You don’t step into volatility and then decide what your risk should be. You know the edge-case conditions before you enter. You already know what a failed breakout looks like. You’ve seen a ghost wick before.

Decision-making is not deterministic; it’s probabilistic.

You’re not trading certainty—you’re trading structure under pressure. The right question isn’t “Is this setup good?”Ask yourself, “Has this setup been earned by behavior, not just geometry?” If your decision isn’t tethered to volume posture or volatility slope, it’s narrative. Narrative doesn’t survive volatility. The market doesn’t necessarily punish slow thinkers, but it does punish those who think slow and long.

⚡ Act

Action is where hesitation kills. This is the moment where all four parts of the Loop compress into execution. It’s not about clicking fast. It’s about acting without second-guessing the work you already did. If you hesitate here, it’s not fear—it’s leakage. It means your observation wasn’t filtered enough. Your orientation held too tight to bias.

Your decision still had hope baked into it.

Action isn’t the end of the Loop. It’s the trigger for the next one. Every entry is also feedback. Every exit is a referendum on the quality of your last decision cycle. Did you size correctly? Did you manage drift or chase adrenaline? Did your thesis survive velocity? This is where most traders fail—not because they can’t analyze, but because they can’t recover from a trade that breaks their story. Emotional hygiene isn’t a soft skill. It’s a structural prerequisite for execution under duress.

You cannot trade cleanly if you haven’t already mapped how you fail.

🪫 Drag = Edge Decay

When the Loop stretches, your edge bleeds. Drag happens when traders over-observe, under-orient, delay their decision, or hesitate on execution … sometimes all four. Drag isn’t always obvious. It might show up as overtrading, or freezing in the middle of a clean setup. It might show up as adding size when the Loop is incomplete. Most often, it shows up in repeating structures that look familiar but no longer carry pressure. That’s orientation rot. You didn’t adapt.

The fastest way to eliminate drag is to ritualize the Loop.

Keep charts minimal. Define what effort looks like. Know what confirmation feels like. Log your failed trades as Loop degradation—not missed entries. Always tag hesitation as data.

🔁 The OODA Loop is Recursive Continuity

Every setup is a new orbit. The trader who loops cleanly, consistently, and with emotional clarity will always outrun the one with more tools and less tempo.

You’re not trying to win the market. You’re trying to stay inside the pressure cycle long enough to recognize structure before it breaks.

The Loop doesn’t forecast. It filters memory for pressure residue. It trades remorse before it becomes momentum.

With discipline and practice , the OODA Loop transforms hindsight into forward recoil.

Leave a comment