The cage may be literal … a concrete room, a locked cell, a checkpoint where your passport is taken and not returned. Or, the cage may be metaphorical. A classroom feels like punishment, as does the Monday morning meeting where time is stolen in the name of teamwork. As many men know too well, a marriage of continual silence or shouting is real confinement. Harshness matters. The meaner your metaphor is, the harder the training will be. The more training hurts (within your limits, short of breaking you), the more transferable the skill of endurance becomes to the rest of your life.

Whether we like to admit it or not, any edge you have is relative, simply because most other people have no edge at all. How do you know if you have one? The other hard truth is that edges are forged and ground, and result from honing. If you’d put in the work, you’d know. Nevertheless, most people believe that when pressure comes they will rise to the occasion. They prefer to imagine that hidden reserves will arise, as if from the crisis itself, and transform them into a better version of themselves. This belief is as pleasant as it is false.

When the fight comes, you do not rise. You sink to the lowest level of your training. If that level is shallow, you collapse; if it is deep, you hold. Survival depends not on sudden strength, but on practice.

I have tested and proven these hard truths in the most punishing conditions I’ve known. I have sat in the cage where choice seemed stolen and time was used as a weapon. What held me together was not toughness, but learned technique. Each lesson, once internalized, applied as cleanly in a cell as in ordinary life. A hostile negotiation, a hostile marriage, a hostile bureaucracy, they all obey the same logic. Tools forged in extremes transfer into every setting where pressure is applied.

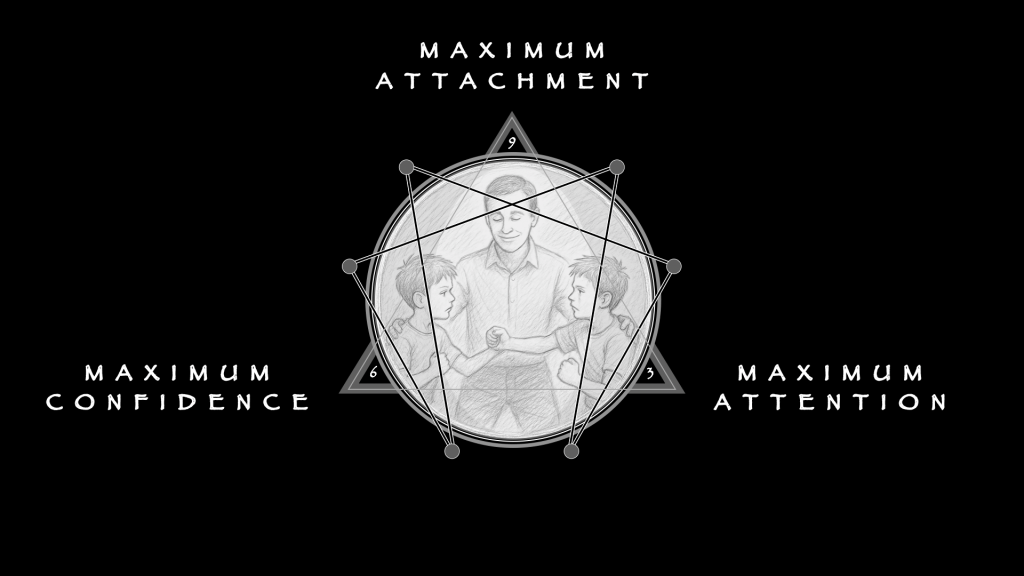

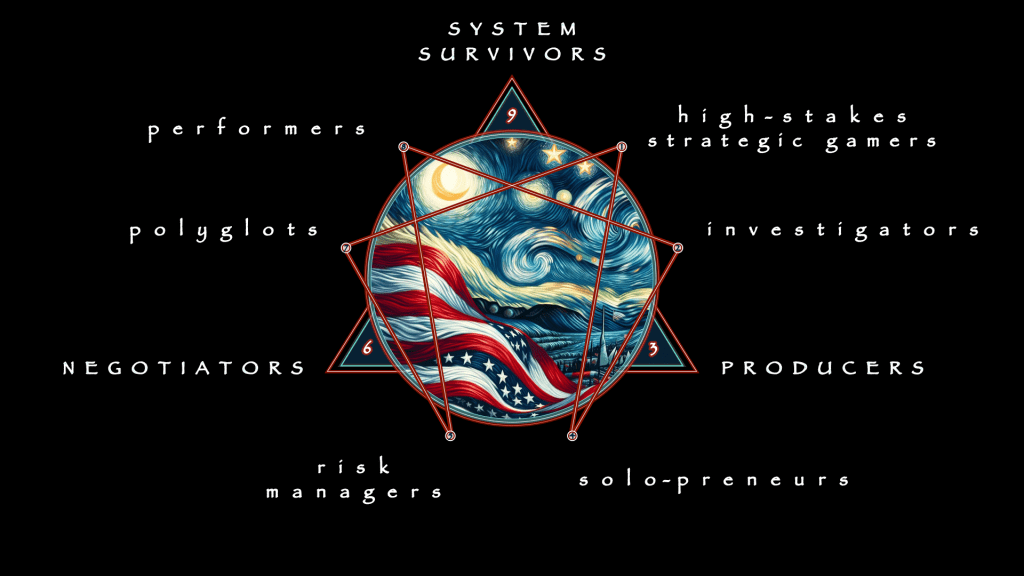

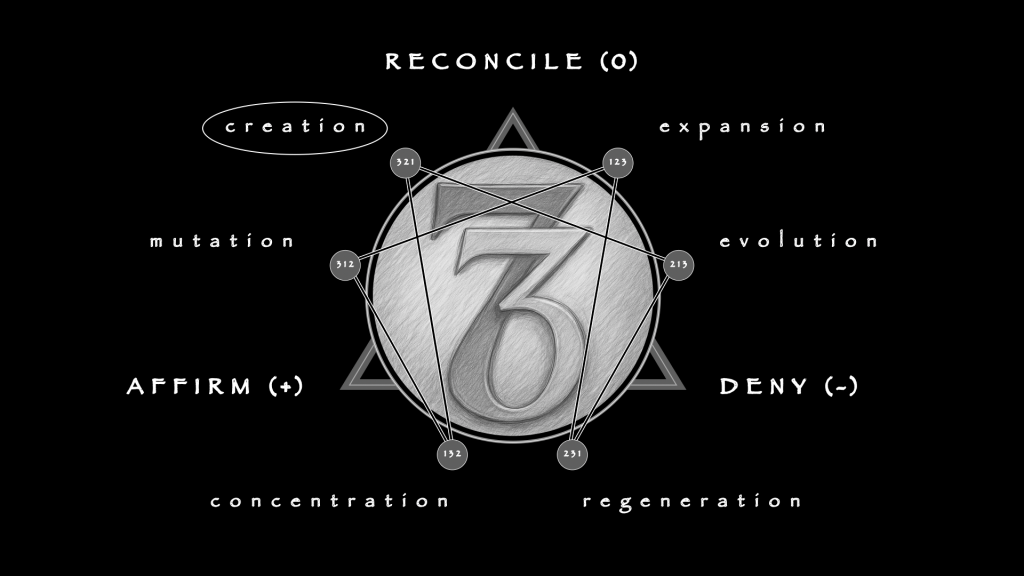

Endurance is a 213 triad, or Evolution.

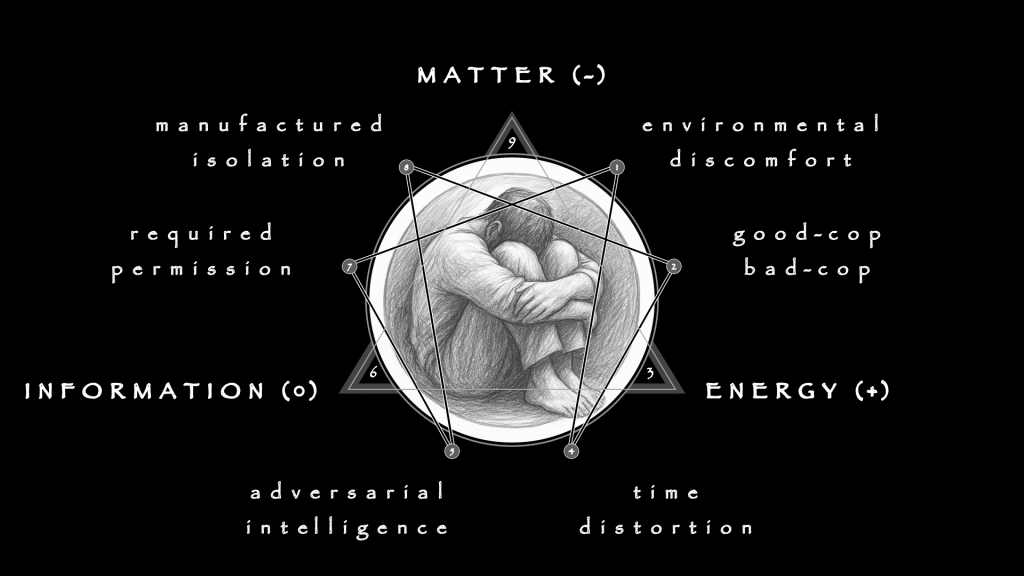

Denial is first and unavoidable: the imposed conditions, the lock, the silence, the schedule that is not yours. These are not metaphors. They set the frame and they arrive before you can act. Affirmation, in the form of will, follows but it doesn’t lead. The work is to bend into what has already said “No.” Restraint, timing, refusal to feed the pressure — each is a reply made under duress. Some can hold, some cannot, but all endurance is this contest of will against denial.

Reconciliation is the result, and is nonnegotiable. Release or non-release—that is the fruition of the sequence. The danger lies in drift: let the pattern slip and the triad collapses. 123 thrashes outward in waste, 231 refines despair into ritual. Worst of all, 132 builds a second cage inside the mind. Training demands that the situation be held as 213, nothing else. Only then does endurance remain lawful, and only then can it transfer intact across domains.

Capture begins not with any handcuffs or a locked door, but with a frame.

The lighting is proverbially skewed, the air stale, and the silence is broken at the interrogator’s whim. You are meant to forget that you still possess choice. The true battle is not against the room, but against the slow erosion of self. Endurance of such moments is nothing like passive suffering. Quite the opposite, it is the gainful art of conserving strength while feeding nothing to your captors. Escape is not cinematic but sly, procedural … and literally boring.

Victory means walking out while they remain convinced that the cage still holds.

The environment is unsurprisingly weaponized, a chair that cuts into your back, a missing clock, drifting temperature. This is architecture as assault, subtle enough to be deniable, persistent enough to grind down lesser men. Interrogators rely on cumulative pressure, small irritations stacked until you pay with compliance just to end the friction. The environment, per se, never breaks you, not directly. It merely invites you to break yourself. Recognition of the pattern is the first step in resistance. If you know the tricks, though, you see them as tricks. The same holds in the office where the air conditioning is dialed down for “alertness,” or in classrooms where tests drag on without clocks. Discomfort is a signal, not a command.

The guards always rotate, whether or not they wear uniforms. One is terse, another tender; one compels, another consoles. The choreography is ancient. Confusion inspires hope, hope breeds betrayal, and betrayal breaks willpower. You might feel relief, when the hostile voice subsides and the gentle one leans in, and that will make you vulnerable. The guards, whether or not they know it, come with the cage, no less than the doors or the plumbing or the telephones. Their faces change but the roles were scripted aeons before any printing press.

The only true variable in the room is you!

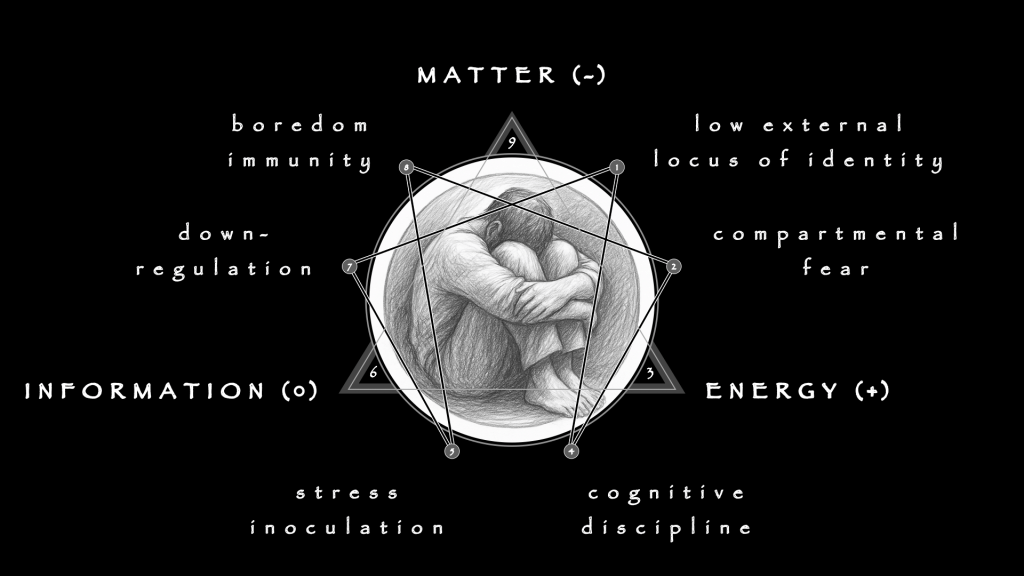

Since brute willpower is a diminishing asset, it is also an unreliable defense. Rather, you need an inner citadel, an architecture of mind immune to the concrete and steel. Such a sanctuary must be built on resilience disciplines: compartmentalization of fear, control of thought loops, inoculation through prior stress, and above all the refusal to leak any tell. The man who can sit still, endure boredom, and radiate nothing has achieved invisibility. To his captors, this silence is unnerving. They expect fidgets, sighs, restless shifts. They do not know how to read boredom endured without trace. That is not absence, but dominance. In a meeting, the same skill unnerves: the executive who waits out a torrent of words without blinking forces others to collapse into the silence.

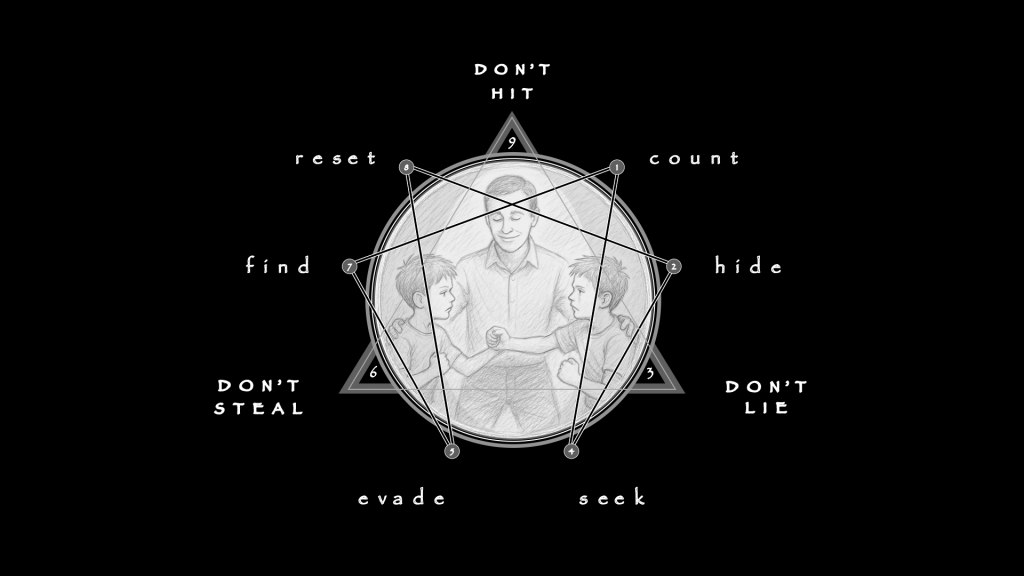

The first Evolution openly disregards the manipulations on which they depend.

Endurance begins with naming these as tools, not truths. Your private citadel strengthens when you separate the environment from your self-concept. You are not cold. You are placed in cold. You are not forgotten. You are temporarily isolated. Every wall is construction. Built things can be endured.

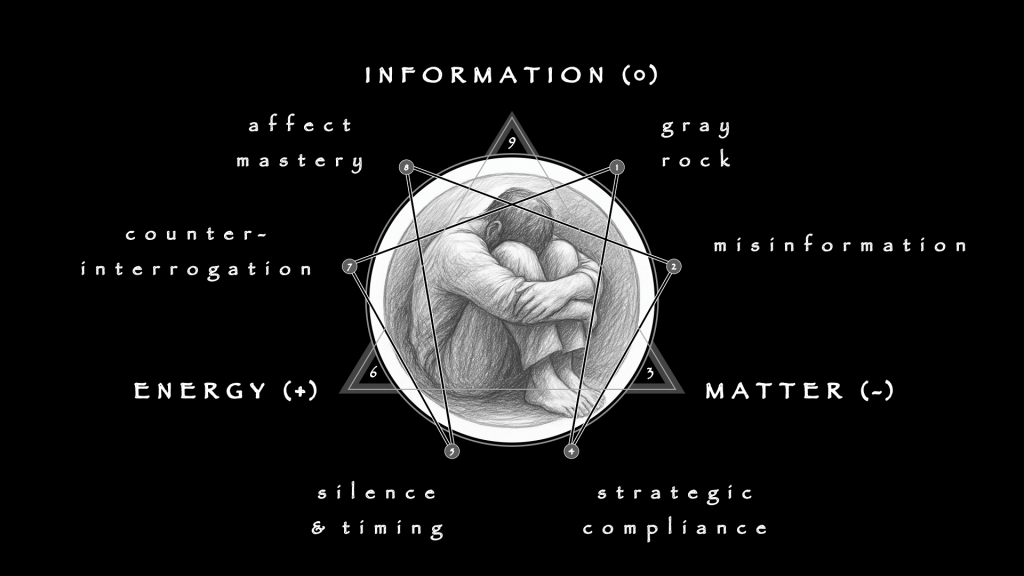

From endurance, you progress to controlled ruses. Compliance, when performed strategically, is a mask. You nod at questions without committing. You agree in form, not in substance. You drop fragments of irrelevant but plausible information to buy time. You answer in ways that lead nowhere, a path paved with detail but devoid of meaning. The interrogator writes notes, satisfied, but nothing of value has shifted. Strategic silence functions the same way: it is not refusal, it is weight. Silence places the burden back on the questioner. Many interrogators fear silence more than lies. The mask protects you until the door swings open on its own.

The second Evolution, buried in your citadel, safeguards the resilience disciplines that others lack, the lockpicks no one can confiscate.

Each preserves agency, and together they buy precious time. Discipline is the universal currency. The longer you cohere, the weaker the captor’s leverage becomes. While adversaries burn their resources, a low external locus of identity conserves yours. The same dynamic holds whenever you endure a drawn-out legal deposition, a corporate performance review, or a manipulative argument at home. Every cage waits for you to cooperate with it. Refuse, and the cage collapses into mere furniture.

Advanced techniques extend beyond defense into escape, though practicing them prematurely can be worse than never doing so. Endurance maintains the citadel.; escape tests the walls. It need not even involve force. With practice, like when a predator spits out live prey whole, a skilled escape artist can dissolve the walls by forcing his captor to lose interest.

The third Evolution comprises “trade secrets”, counter-techniques that escape disguises as endurance.

Gray Rock makes you uninteresting: a detainee with no emotional color, no dramatic profile, offers no hook to exploit. Interrogators grow bored and redirect their energy elsewhere. The Gray Rock wins by starving the captor of stimulation. In office politics, it is the colleague who reveals nothing in a toxic meeting. But use it too obviously, and it looks like defiance.

Misinformation sows waste: details that sound credible but lead to dead ends, requiring days of verification. The captor believes they possess insight, but all they hold is sand. Resources drain as time is squandered. In negotiation, it is the harmless detail that burns the other side’s time. Too much misinformation, though, risks pattern detection.

Strategic Compliance buys relief: small agreements offered as currency to earn pauses or comforts, while protecting what matters. A scrap of harmless detail purchases food, warmth, or rest. The appearance of cooperation misleads the captor into relaxing their pressure. In bureaucracy, it is signing forms that concede nothing. But compliance used carelessly becomes concession.

Silence and Timing force interrogators into over-explaining, revealing more than they intended. Questions left hanging drag the captor into filling the void. What was supposed to be pressure on you becomes a monologue from them. In law, it is the witness who lets silence draw out admissions. Yet silence wielded without calibration can look like stonewalling, inviting escalation.

Counter-Interrogation flips the script: you ask small questions back, subtle enough to feel like clarification, sharp enough to test their footing. “What exactly do you mean by that?” “Who asked for this information?” By answering, they expose seams in their own operation. In business, it is the buyer who asks questions that unsettle the seller. But press too hard, and you reveal intent.

Affect Mastery masks your stress, hides your tells, and projects composure where none exists. You regulate micro-expressions, voice tone, even posture. The captor reads calm and assumes control, while inside you are counting seconds. In marriage, it is masking fatigue so anger finds no purchase. Affect too controlled, though, can feel unnatural and provoke suspicion.

These are never ends in themselves. Each tactic is preparation for a passage, a discipline that endures only so it could culminate. Endurance carries its burden through denial and will; creation inherits it and closes the arc. Without that passage, endurance decays into drift or collapse. With it, the pressure that once threatened to grind you down becomes the condition of release. Evolution ripens into creation, not by chance, but by following the order of forces through to its lawful end.

The sequence begins with the small, almost beneath notice: a misplaced file, a guard whose attention falters, a bureaucratic window that opens without announcement. At first it feels trivial, even fragile. Yet this minor aperture is the reconciling force that nothing can proceed without. What was once impossibility becomes permission.

Denial comes next, and it sharpens the test. The system reacts — alarms sound, eyes narrow, questions return with edge. Interrogators grow suspicious, colleagues probe, bureaucracy flares with last-minute demands. This resistance is proof the opening is real. Without denial, movement is drift; with it, the path becomes defined. Pressure validates the seam.

Affirmation is final. A line is signed. A door is crossed. A chair is left empty. The gesture is smaller than the preparation that preceded it, yet it seals the deal. No proclamation is needed. The act is complete because the order has been honored: opening, resistance, and then, quietly, departure.

This is the action along the 2⟶8 line: what was stripped away at 2 becomes fuel for enablement at 8. Tactical loss becomes strategic completion. Time stolen, options closed, and strength narrowed are transmuted into a freedom stable enough to endure. Creation is not escape by chance but by conversion, the lawful turning of pressure into absence.

Anything less is counterfeit. A jailbreak that ends in flight is not culmination but relapse into 132, the will trapped in vigilance, every choice forced through the lens of survival. Real escape does not orbit the institution; it leaves it behind. The walls remain, but you no longer acknowledge them as reference.

The cleanest escapes look uneventful. Files close. Detainees are walked out the front door. Cases vanish from the ledger. Nothing spectacular happens, yet everything has changed. To those who watched, the system still seems intact. To the one who has crossed, the institution has already dissolved.

Escape, when it holds, does not declare itself. It leaves no trail but the incomplete story that your captors tell, a monument to a world you have already abandoned.