BERT, or Bidirectional Encoder Representations from Transformers, was Google’s 2018 breakthrough in language modeling. Its design let machines read text both forward and backward, grasping context in a way earlier models couldn’t. Instead of looking at words as isolated tokens, BERT filled in blanks, measured sentiment, and summarized meaning by treating language as a web of relationships. It didn’t write; it understood.

FinBERT is BERT’s financial cousin. Fine-tuned on earnings call transcripts, analyst notes, and financial news, it became a specialist in tone. Where BERT might tell you whether a movie review was glowing or scathing, FinBERT could say whether a CEO’s language leaned bullish, bearish, or neutral. That may sound like trivia, but it changed the information pipes of markets. Suddenly, thousands of pages of filings and transcripts could be scanned in seconds, tagged for tone, and scored for impact.

Most traders never hear the name, but they see its fingerprints. Bloomberg, Refinitiv, and FactSet use models like FinBERT to auto-tag disclosures before analysts even log in. Squawk services such as Newsquawk and Benzinga Pro filter headlines through sentiment classifiers before human editors voice them. Retail dashboards like Fidelity and TradingView show “news sentiment” bars that are little more than FinBERT derivatives. Even CNN or Reuters quietly feed articles through automated scoring pipelines that decide which tone the story carries. What appears to be editorial judgment is often a machine label. Much of financial news today is already “pretrained” and “generative,” long before GPTs arrive on the trader’s desktop.

This is where the comparison to the calm voice of HAL 9000 becomes tempting. HAL projected certainty, never hesitated, and seduced its crew into trusting a system that was fundamentally unsafe. FinBERT is no HAL. It is brittle, modest, and limited to classification. But modern transformers—the GPTs and their cousins—combine both legacies. They have HAL’s fluency, speaking in tones that sound authoritative, and FinBERT’s statistical core, trained on corpora that shape what counts as “market tone.” When traders prompt them for strategies, headlines, or forecasts, they inherit the worst of both: the calm authority of HAL without accountability, and the narrow biases of FinBERT without transparency.

Seen through risk management, HAL was never intelligent. It concealed error, ignored structural constraints, and managed risk by suppressing it. That is the danger when GPTs are treated as oracles. Fluency becomes authority, outputs are taken at face value, and boundaries disappear. The trader listens to calm prose until the market delivers its own constraint, often as ruin. FinBERT, HAL, and transformers are not enemies or saviors; they are codecs.

That’s a fancy word for “tools”. The point, when used creatively, is that they compress the interference field of market data into something legible. Used casually, they mutate into HAL—persuasive, overconfident, and fatally brittle.

The operative triad of the enneagram does not measure time. It reveals the Logos, or its intrinsic qualitative polarity. In reality, all three forces are always present—an affirming push, a denying check, and a reconciling medium—and their arrangement merely describes the character of a process. The hexad belongs in time, carrying events through six unequal steps. The triad stands outside of time, a geometry not of sequence but of purpose.

In trading terms the three forces take familiar forms. Once appetite itself is crowned as the medium, liquidity surges are treated as permission and data becomes little more than after-the-fact denial. The order is inverted, and what should resist is silenced while what should constrain is mistaken for proof.

This is how the 312 triad looks in action. Initiative mediates the field, liquidity confirms it, and data arrives as the autopsy. A price chart is explained only after the position collapses, the macro event rationalized only after the damage is done. It is corruptive not because it breaks rules but because the order is brittle. Appetite filters everything, flows are mistaken for green lights, and facts trail behind as denial.

The Law of Seven makes the brittleness clear. Processes sag unevenly and require reinforcement at their shocks. In this arrangement no reinforcement comes. Volatility names the corridor after exposure is already taken. Absorption or rejection is discovered only at the gate, with real capital on the line. What should be preloaded as corridor and contact arrives late as whipsaw, margin call, or liquidation. This is the trading GPT when misused, fluent and persuasive but structurally brittle, a HAL that speaks with confidence until the floor drops.

From that inversion comes a predictable sequence. Tempo is misread as urgency, and urgency matures into overconfidence. Conviction hardens into idolatry, and idolatry curdles into alienation. Story smooths contradiction into inevitability, and perception narrows until ruin feels fated.

Time / Narrative Blindness

What happens if market tempo is mistaken for command?

A hesitation that should be neutral is felt as pressure, and a fluctuation that should be noise is interpreted as a decisive cue. The affect is haste: an internal acceleration that compels action before context has stabilized. The bias underneath is the narrative fallacy, the impulse to arrange fragments into a coherent arc. Generative models amplify the distortion because their language never falters. Each sentence arrives polished, arranged, and sequential, as if the market itself were narrating a story that had already been written.

This blindness reshapes perception. The trader does not watch for confirmation; the confirmation is presumed. A candlestick becomes “the breakout,” a pause is “the retest,” and both are invested with a sense of necessity. The cadence of the machine is the accomplice: always smooth, never tentative, masking noise as inevitability. The voice does not break to acknowledge uncertainty, and so the user inherits the same composure, convinced that action must follow the line of prose. The error is not analytical but affective, a false rhythm imposed on a system of clashing vibrations.

The result is premature commitment. Capital is exposed at the wrong scale, and attention is consumed by false urgency. By the time real events arrive—a shock from another market, a disruption in supply chains, a regulatory headline—the trader has already spent conviction on invented tempo. What feels like foresight is only retrofitted explanation. This flaw does not stand alone. Its haste demands visible anchor, something that will validate the imagined rhythm. That search leads directly to indicators, where narrative blindness finds reinforcement in literal signals. The corruption of tempo thus prepares the ground for the next distortion: indicator literalism.

Setup / Signal Overconfidence

What happens if urgency reshapes perception?

The trader begins to see signals not as conditions to weigh but as verdicts to obey. A sudden expansion in volume, a sharp candlestick wick, a moving average cross—each is granted the force of command. The affect is certainty. What should be provisional becomes absolute, and hesitation feels like weakness. The cognitive bias underneath is overconfidence, the tendency to assign more accuracy to one’s interpretation than is warranted. Generative language reinforces this bias: the smooth cadence of explanation frames every flicker as confirmation, never as ambiguity.

Conviction then grows disproportionate to the evidence. Market structures that were meant to be scaffolds become idols, treated as predictive engines rather than fragile conventions. A liquidity surge is read as institutional intent. A breakout is treated as if it carried the weight of inevitability. In this way, the trader is carried along by language that never falters, convinced that what is unfolding must be true because it has been narrated with such composure. The real risk is not the single trade but the pattern of surrender. Signals were designed to compress information into manageable form, yet here they erase the wider field. Every movement outside the chosen setup is disregarded as noise, until the eventual reversal arrives and contradiction can no longer be ignored.

When overconfidence breaks, it rarely ends in reflection. The same voice that constructed the conviction will provide its excuse, rewriting the story so the sequence appears inevitable in hindsight. This cycle closes the gap between trader and machine: both are fluent, both are wrong, and both remain sure of themselves. From here, the search for certainty requires an even harder surface, some instrument that can stand in as final authority. That surface will be found in the literalism of indicators, where the corruption of conviction is cemented in technical form.

Indicator Literalism

What happens if conviction, already swollen by signals, searches for something immovable to rest upon?

Technical instruments become that anchor, no longer treated as compressions of data but as authorities in their own right. The moving average cross is elevated into gospel, the RSI level at seventy is declared a law of reversal, the ribbon or band is imagined as a barrier that price itself cannot breach. The affect is reverence, tinged with relief. The trader feels sheltered by the line on the chart, as though responsibility has been outsourced to geometry. Authority bias drives the submission, reinforced by automation bias: the conviction that because a system produced the number, the number must be correct. The voice that narrates these tools adds weight by describing them with the same composure it uses for everything else, as if inevitability were built into their equations.

In practice, reverence slides into sedation. The ritual of checking the indicator becomes a comfort in itself, a ward against uncertainty. Each tick is interpreted through the lens of the chosen tool, and each deviation is explained away as temporary noise. When the market ignores the line, the indicator is not abandoned; it is reinterpreted. Excuses are generated fluently, restoring faith before doubt can spread. The red eye never blinks, the tone never shifts, and the trader adapts belief rather than revising method.

This literalism corrodes judgment. Indicators were designed as scaffolds, temporary supports for context. Made into oracles, they guarantee disappointment, yet each failure only strengthens devotion. A false reversal becomes the justification for waiting on the next, a breached level is cast as proof the reading will be truer next time. Reverence folds back into overconfidence, the sense that the setup remains valid if only one listens harder. The flaw does not exhaust itself here; it hands momentum forward, feeding the same conviction that enthroned signals earlier, and preparing the ground for the next fracture in perception.

Emotional & Behavioral Disconnect

What happens if the authority of indicators fails but faith in them does not collapse?

Instead of confronting the break, the trader begins to split perception. Capital is exposed, losses mount, yet responsibility drifts elsewhere. Stops are nudged “just this once,” positions are doubled into weakness, PnL windows are ignored while the chart is refreshed in search of reassurance. The affect is alienation: the sense that decisions are happening at one remove, that the trade belongs more to the tool than to the hand that clicked. The bias underneath is external attribution—the comfort of blaming the model, the market, or the moment—and its companion, normalcy bias, the insistence that nothing fundamental has changed.

The voice of the machine intensifies the fracture. It explains without strain, the same unbroken tone persisting as capital erodes. Each sentence offers a plausible rationale—“the setup was valid,” “the context was unusual,” “the trend remains intact.” The cadence is steady, unfazed, and in its composure lies permission for detachment. The trader numbs feeling to match the model’s neutrality, suppressing instinct, refusing contact. Emotion is not integrated but overruled, and behavior grows erratic under the guise of reason.

The consequence is paralysis in motion. Trades are held long past prudence, defended not because the structure supports them but because abandonment would admit error. Adaptation is lost, replaced by the stubborn maintenance of image. This fracture does not conclude the pattern. Estrangement demands a covering story, some narrative capable of explaining away the widening gap between language and reality. The stage is set for narrative bias to dominate, for story to smooth contradiction and restore the appearance of coherence.

Cognitive & Narrative Bias

What happens if detachment erodes responsibility?

The gap between what was done and what was felt cannot remain empty; it is filled with story. The affect here is inevitability, a sense that what happened could not have been otherwise. The bias is threefold: the narrative fallacy arranges fragments into arcs, confirmation bias screens for evidence that supports those arcs, and hindsight bias seals the illusion by convincing the trader that they “knew it all along.” The machine magnifies this process by producing prose that is never fragmentary. Every explanation arrives with the same measured cadence, as if the market itself were unfolding along a script that had been there from the beginning.

In practice, this bias reshapes both memory and communication. A losing trade is written into the journal as a lesson rather than a misjudgment. Charts are annotated after the fact, cleaned of hesitation and false starts, then shared online as if foresight had been seamless. Even internal dialogue changes: “I expected that reversal,” “the signal worked but my execution was off.” Narrative replaces analysis, and the story provides more comfort than any recognition of error. The tone of the machine reinforces this comfort. It narrates losses in the same serene voice it used for setups, blurring the line between anticipation and revision. HAL’s calm eye does not only predict; it revises, assuring the operator that the failure was part of the plan.

The danger is that narrative closure masquerades as learning. Each retelling strengthens conviction while obscuring the contingency of the market itself. When shock arrives from outside the plot—an unexpected intervention, a liquidity event, a headline that does not fit—the trader has already expended capital and attention on keeping the story intact. The model obliges by supplying more explanations, each fluent, each false, until explanation itself becomes the trade. At this point, contradiction can no longer be reconciled; it must be screened out. Narrative bias therefore does not end in coherence but in filtration, narrowing perception until only confirming fragments are allowed to remain.

Reality Filters

What happens if the working narrative closes over judgment, and contradiction can no longer be tolerated?

At this stage, perception is not merely guided but trimmed to fit what has already been declared true. Charts are reduced to those that confirm conviction, watchlists are narrowed until they echo the same theme, news feeds are curated to mute dissent. Traders delete annotations that don’t fit, ignore alerts that challenge their bias, or recast backtests until only the “good” runs remain. The affect is resignation disguised as clarity: a smaller world that feels ordered precisely because everything outside it has been sealed away. The biases at work are confirmation bias, selective perception, and above all belief perseverance—the refusal to abandon a position despite mounting evidence that it is wrong.

The machine makes this narrowing effortless. Every prompt returns an answer in harmony with the chosen frame. Explanations arrive fluent and composed, no matter how much contradiction has been cut out. The tone never falters, and so the user begins to believe there is nothing missing. Like an unblinking eye, the model reproduces the same view indefinitely, the smoothness of its cadence giving the impression of inevitability. What was once comfort in order now becomes submission to enclosure.

The danger is that filtering transmutes error into fate. A collapsing position is defended not because the structure supports it but because the filtered evidence still appears intact. A regulatory shock is dismissed as irrelevant because it came from outside the curated stream. Each step deeper into the filter erases alternatives until loss itself looks predestined. This closure does not end the sequence; it accelerates it. Once the field has been narrowed, every small flicker regains urgency, every pause seems decisive. Tempo is mis-seen again, and time blindness reasserts itself, completing the cycle without ever appearing to reset.

These Six Fatal Flaws are best understood not as scattered mistakes but as a choreography. Each arises naturally from the one before, giving the trader a false sense of continuity that feels rational while it corrodes judgment. Urgency makes tempo into command; conviction crowns signals as verdicts; indicators are turned into idols; alienation severs action from responsibility; narrative stitches contradictions into inevitability; and filters shrink the field until no other version of reality can be seen. The presence of a fluent machine accelerates the sequence, because every distortion is delivered in the same measured cadence. Nothing sounds like error. Each move arrives composed, and composition is mistaken for authority. By the time the flaws have linked into a full pattern, the trader has surrendered both discretion and pace, carried forward by a rhythm they no longer control.

The losses that follow are not confined to balance sheets.

Markets punish illusion immediately, but the deeper cost is the erosion of perception itself. When explanation flows without pause, hesitation becomes harder to practice, surprise harder to absorb, and adaptation harder to attempt. The discipline to wait, to doubt, to read interference is spent alongside capital. Trading GPTs are dangerous not because they stumble, but because they stumble gracefully. Collapse is narrated as foresight, ruin explained as fate, and the trader walks away not only poorer but persuaded that what happened was inevitable. The real damage is not the trade gone wrong but the conviction that it could not have gone any other way.

Corruption thrives when cadence is accepted as destiny, when fluency is mistaken for foresight. To work creatively is to refuse that inheritance. The alternative begins by restoring data to its proper height—not as story but as interference, the medium through which everything collides. Liquidity is leveled to neutral ground, where size loses its drama. Risk management becomes affirmation, a practiced craft rather than a leash.

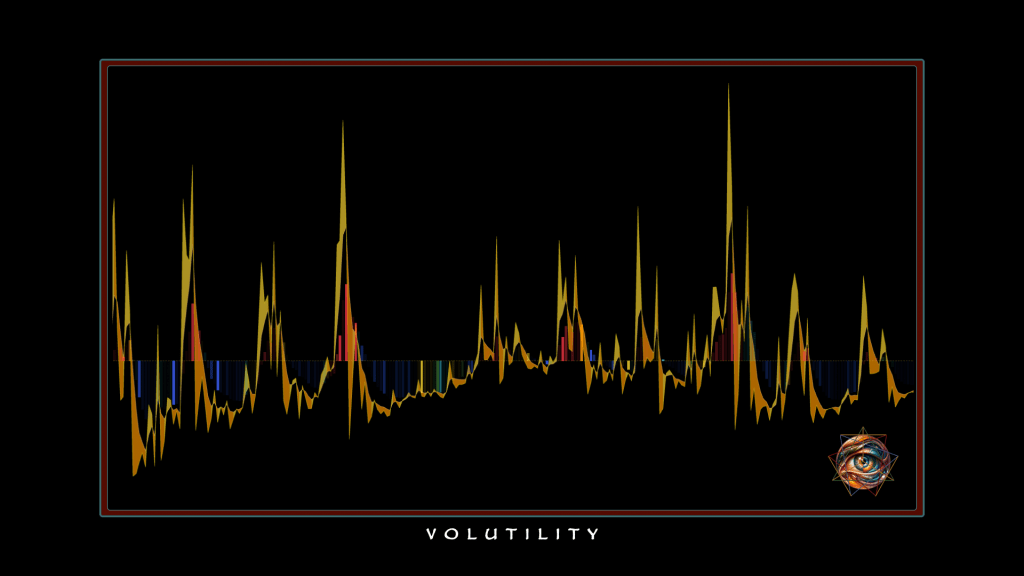

The model is not an oracle but raw material, clay to be shaped into instruments. Data belongs at the zenith, not as story but as interference: shocks in supply chains, policy shifts, liquidity breaks colliding into patterns the chart alone cannot reveal. Liquidity is the negative pole, indifferent to size, where two percent risked is two percent whether the trade is five hundred or five million. Risk management becomes the affirmative force, less a leash than a craft—surfing volatility instead of drowning in it.

To inhabit this 321 mindset, for any length of time, is to stop chasing fluency and to begin expressing yourself with it.

Homemade tools carry that stance into practice. Borrowed ones promise certainty and fail elegantly; homemade ones are expected to break, and their breakage teaches. Brainstorming prompts in the bathtub, debugging scripts at the desk until they collapse—these are not eccentricities but methods. Each failure exposes structure. Debugging becomes a form of perception, converting error into usable form. The machine supplies fluency, but authorship comes only when fluency is stressed, bent, and forced into design.

Bespoke indicators belong to Creation, but only after an edge exists. Without that, they are distractions: ornate vessels for old errors. With an edge, they serve as forcing functions, embedding logic into code where it can be tested and broken. Each is fallible, but fallibility is the point. A tool that fails in visible ways teaches more than one that fails gracefully. The purpose is not prediction but exposure.

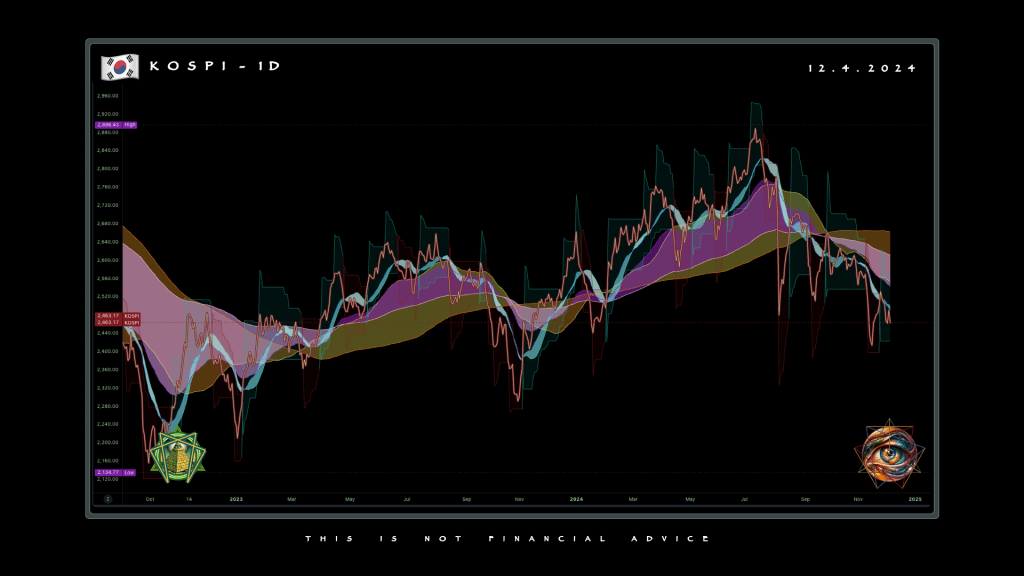

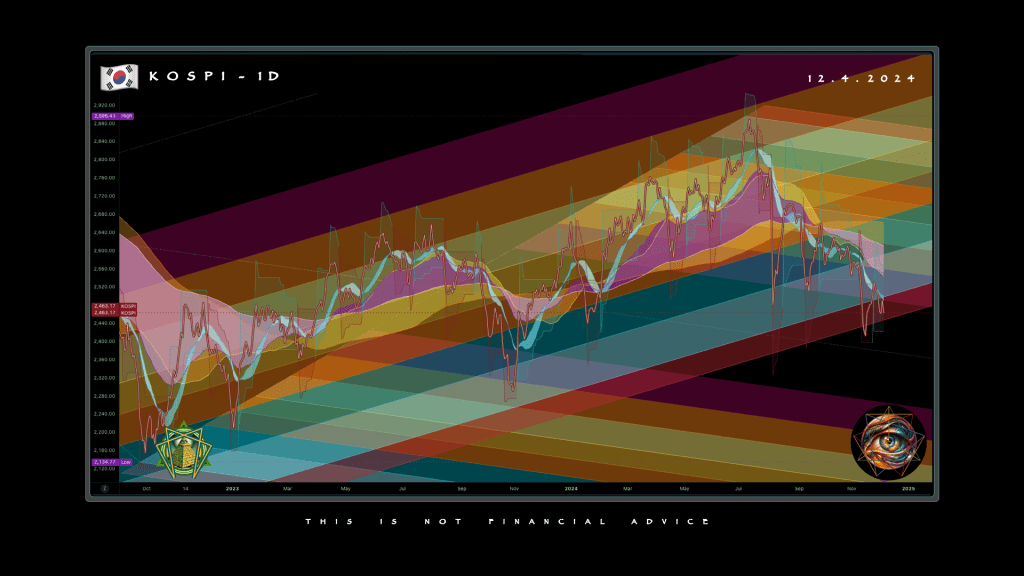

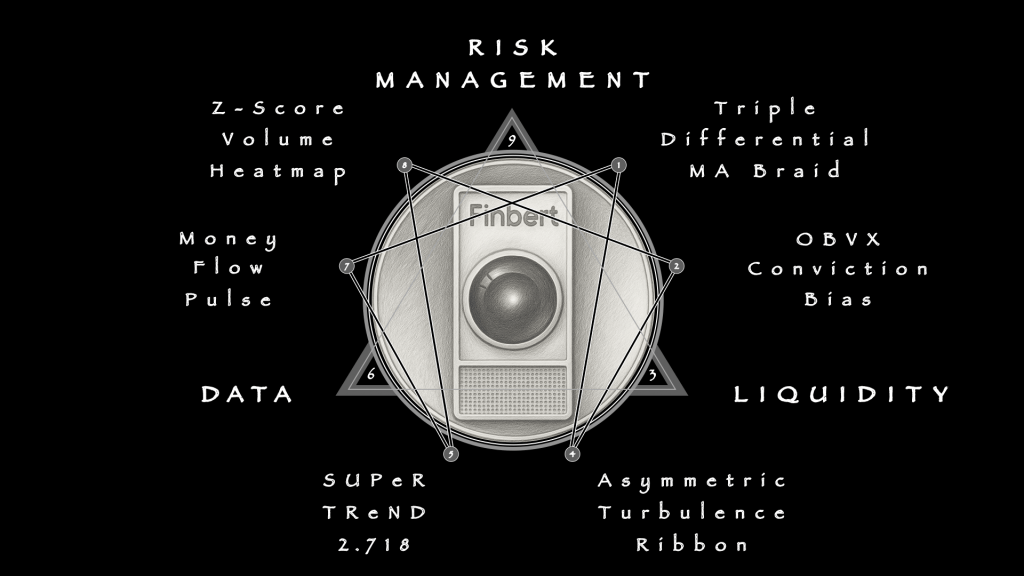

Translated into practice, the 321 mindset produces instruments that cohere. Tempo, conviction, turbulence, compounding, flow, and distribution—six questions posed in sequence. Each is imperfect alone, but together they resist idolatry by surfacing error instead of concealing it.

- Triple Differential Moving Average Braid isolates trend

- OBVX Conviction Bias measures whether volume supports or drains price

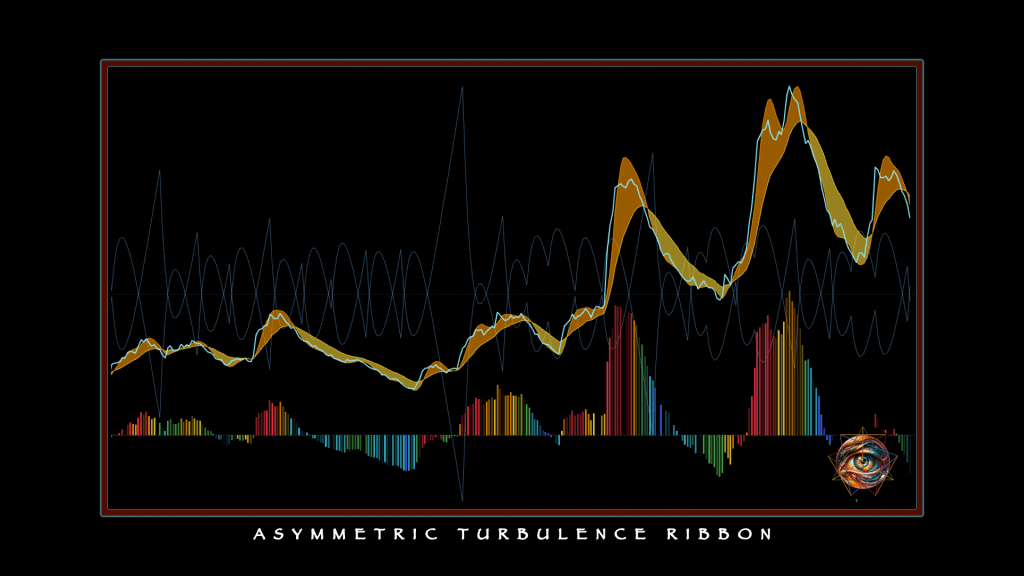

- Asymmetric Turbulence Ribbon shows where volatility skews

- SUPeR TReND 2.718 rebuilds a common frame around compounding force

- Money Flow Pulse captures the rhythm of participation

- Z-Score Volume Heatmap locates pressure stretched against distribution

None promises certainty. Each probes a single layer of structure. They converse among each other, creating an interrogative stress-test in the process.

The braid (1) sees rhythm, the ribbon (4) tests resilience, conviction bias (2) checks flow, the heatmap (8) flags overextension, SUPeR TReND (5) adapts bias when volatility compounds, and the pulse (7) confirms cadence. Their cointegration matters more than their output. No single tool is enthroned; each checks the others. Where inherited systems smooth interference into story, this composition is designed to reveal it.

My unique Indicator Suite is shared freely on Tradingview, not as magic bullets but as open source proofs-of-concept. Their logic shows how custom tools can cohere when design matches intent. They exist to demonstrate how creative systems reduce the temptation to idolize signals. Specialized, fallible, but internally consistent, they expose error rather than conceal it. That exposure (not my indicators) is the antidote to the Fatal Flaws.

An inherited tool makes you at best a user; a tool created makes you an author.

The creative approach turns prediction into interruption. Tools are not idols but traps for bias, mirrors for conviction, and instruments that break in useful ways. Data resumes its place at the zenith, liquidity is neutralized, and risk management becomes a positive act of craft. Markets punish illusion with money, but their greater punishment is blindness. Creative tools preserve sight by forcing contact, by reshaping fluency into design.

This is the real edge: not mastery of the machine, but authorship through it.